Taiwan Tax Benefit Application on Article 25 of the Income Tax Act ams2tw

For enterprises that received approval for the tax benefit, the withholding tax rate on its income from Taiwan will be significantly reduced from 20% to 3% or 2%. Businesses whose headquarters are outside of Taiwan must apply for the tax benefit described in Article 25 of Income Tax Act with the Ministry of Finance and 15% of its business revenue within Taiwan would be the taxable income.

e-mail: ams2tw@evershinecpa.com

or

For Netherlands going-out cases, the coordinator window will be

Evershine Management and Consulting GmbH

Project Manager Anna Wang , who speak in Dutch, English and Chinese.

Call us in working hours (Taipei and China Time)

Manager Jerry Chu, USA Graduate School Alumni and a well-English speaker

Mobile: +886-939-357-735

Tel No.: +886-2-2717-0515 ext. 103

Significantly reduce your tax rate from 20% to 3% or 2%.

Article 25 of the Income Tax Act, businesses whose headquarters are outside of Taiwan must apply for the tax benefit described in Article 25 of Income Tax Act with the Ministry of Finance and 15% of its business revenue within Taiwan would be the taxable income.

For enterprises that received approval for this tax benefit, the withholding tax rate on its income from Taiwan will be reduced from 20% to 3% or 2%.

Article 25 (ATC 25) of Taiwan’s Personal Income Tax Law states:

Any profit-seeking enterprise having its head office outside the territory of the Republic of China, and which is engaged in

1)international transport,

2)construction contracting,

3)providing technical services, or

4)machinery and equipment leasing, etc.,

in the territory of the Republic of China, and the cost and expenses of which are difficult to calculate may apply for approval from the Ministry of Finance, or the Ministry of Finance may make the decision to consider 10% of its total business revenue for an enterprise engaged in international transport business, or 15% of its total business revenue for one engaged in any other businesses as its income derived within the territory of the Republic of China regardless whether or not it has a branch office or business agent in the territory of the Republic of China. In such cases, however, the regulation in Article 39 regarding the deduction of losses cannot be applied.

Effective Tax Rate

| Deemed Profit Ratio | Tax Rate | Effective Tax Rate | |

| 1)International transport | 10% | 20% | 2% |

| 2)Construction Contracting | 15% | 20% | 3% |

| 3)Technical services | 15% | 20% | 3% |

| 4)Equipment leasing | 15% | 20% | 3% |

For Example:

With ATC 25 Approval

If a foreign company receives ATC 25 advance ruling approval on a technical service contract, deemed profits on a NTD 2 million contract will be NTD 300,000. Net tax payable on the contract revenue will be NTD 60,000 (NTD 300,000*20%).

Without ATC 25 approval

Applicable withholding tax on the same contract would amount to NTD 400,000 (NTD 2 million*20%).

Mechanism of Paying Tax

If the foreign company does not have a permanent establishment in Taiwan, the Taiwan customer should, in accordance with Article 88 of the Income Tax Act, deduct 3% withholding tax and remit the net amount to the foreign company.

If the foreign Company has a permanent establishment in Taiwan, the Taiwan permanent establishment should issue a VAT invoice to the Taiwan customer and book the contract revenue in its accounting record. Tax is paid at the time the corporate income tax return is submitted. The due date is five months after the end of the fiscal year.

Application and Approval Timeline

ATC 25 is an advance ruling application.

Generally, we will suggest to send out the application before work kick-off , but only after the commencement date of the contract.

It takes approximately one month to obtain approval.

Experienced Professionals Serve You

We have very experienced professionals to serve clients for ATC 25 applications.

We help clients evaluate whether an advance ruling application is appropriate for their circumstances, and assist clients to formulate effective tax planning solutions.

Service Description :

We are quite familiar with this application and elapsed to provide you the services related to the Article 25 Application of Income Tax Act. Regarding to the procedure, required documents, and our service charges are described as follows:

1. Procedure

1.1 Apply to the Taxation Bureau, Ministry of Finance for the Article 25 Application of Income Tax Act.

Any amendment or extension letter to the contract will be defined as another contract and a separate service charge will be raised.

1.2 Apply to the Revenue Service Office for the stamp tax investigation.

Stamp tax of the contract is calculated by 0.1% of contract value.

2. Required Documents

2.1 Power of Attorney (must be signed and printed on company letterhead)appointing the agent (Evershine) to handle the application.

2.2 The Certificate of Incorporation of Your Company

2.3 The copy of the contract signed between Your Company & Taiwan Client.The contract, written in Chinese. If the signed contract is in a language other than Chinese, then the contract must be translated into Chinese. There is no need to sign the Chinese translation. A brief description of the parties that signed the contract.

2.4 Any other supporting documents that tax officer may request upon reviewing the application.

3. Service Charges

3.1 Service fee will be per contract, not including Out–of–Pocket expenses as described in below 3.2.

3.2 Out–of–Pocket expenses:

these expenses may occur by handling the application including taxi, postage, translation fee and stamp tax, etc.

4. Payment Term

4.1 Before starting the application, you will need to pay us the total amount of service fee.

4.2 After received the approval letter and stamp tax investigation letter, you need to pay us the real incurred out–of–pocket expenses.

Contact Persons

e-mail: ams2tw@evershinecpa.com

or

For Netherlands going-out cases, the coordinator window will be

Evershine Management and Consulting GmbH

Project Manager Anna Wang , who speak in Dutch, English and Chinese.

Call us in working hours (Taipei and China Time)

Manager Jerry Chu, USA Graduate School Alumni and a well-English speaker

Mobile: +886-939-357-735

Tel No.: +886-2-2717-0515 ext. 103

or

Julia Shen

Juliashen@evershinecpa.com

+886-2-2717-0515 ext. 123 or +886-975-077867

Additional Information

Taipei Evershine CPAs Firm

6th Floor, 378 Chang Chun Rd.,Zhongshan Dist., Taipei City, Taiwan R.O.C.

Near MRT Nanjing Fuxing Station

Principal Partner : Dale C.C. Chen

CPA in Taiwan+China+UK/ MBA+DBA/ Patent Attorney in Taiwan

Mobile: +86-139-1048-6278

in China ;

Mobile:+886-933920199

in Taipei

Wechat ID: evershiinecpa ;

Line ID:evershinecpa

skype:daleccchen ;

Linking Address: Dale Chen Linkedin

Evershine Global Service Sites for Reference:

Evershine’s 100 per cent affiliates:

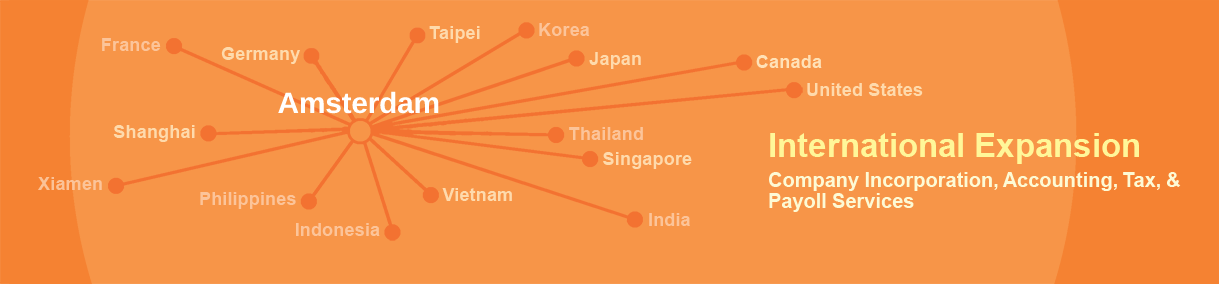

Taipei Evershine.tpe, Shanghai YEvershine.sha, Beijing Evershine.pek, Xiamen Evershine.xmn, Evershine San Francisco.sfo, Amsterdam Evershine.tyo, Seoul Evershine.sel, Hanoi Evershine.han, Bangkok Evershine.bkk, Singapore Evershine.sin, New Delhi Evershine.del, Manila Evershine.mnl, Berlin Evershine.ber, London Evershine.lon, Jakarta Evershine.cgk, Merlbourne Evershine.mel

Other Already-providing-service Cities:

Kaohsiung, Hong Kong, Shenzhen, Dongguan, Guangzhou, Qingyuan, Yongkang, Hangzhou, Suzhou, Kunshan, Nanjing, Chongqing, Xuchang, Qingdao, Tianjin, Sydney, Australia, Kuala Lumpur, India 4 cities, Vietnam, Jakarta, Manila, Turkey, Istanbul, Japan 4 cities, Paris, Amsterdam

Potential Serviceable Cities:

For any other city you wish to visit, please refer to the following two websites,

IAPA Find out Member Firm of IAPA

and LEA Find out Member Firm of LEA

This is the membership of Evershine’s international accounting firm in each city

About 900 member offices, 38,000 people, 450 cities

We can arrange services for your company’s overseas subsidiaries as long as you are in these cities

Please contact us through HQ4ams@evershinecpa.com

More services in more cities please click Sitemap