#BeijingRegistration #BeijingPayroll #BeijingAccounting #BeijingTax #ChinaRegistration #ChinaPayroll #ChinaAccounting #ChinaTax #ChinaEmploymentOutsoucing #ChinaExpatriate #ChinaPEO #ChinaTrademark #ChinaPatentFee #ChinaDD

Contact us by email:

E-mail: ams2cn.north@evershinecpa.com

Beijing and Netherlands colleagues work together to serve you.

Contribute to global warming and reduce air travel.

In addition to providing foreign company registration, Evershine assumes your local internal accounting role, undertaking accounting, tax, payroll and other compliance services, supported by cloud accounting and payroll systems.

Beijing Company Registration

Service Coverage

*Company Registration

Trademark Registration

*Work Permit Application

*China Z-Visa Application

*Work Certificate Application

*Residence Permit Application

The procedures to register a WFOE (Wholly Foreign Owned Entity) are:

Require → Consult → Engage → Register

Evershine CPAs Firm Service Features

Staff speaking in English & Chinese. International tax planning assistance by Taiwan headquarters with English, Japanese, Indonesian & Malaysian speakers.

How to know what kind of entity to register in China?

| With Tax ID? | Issues Sales Invoices? | Legal Entity? | Wholly owned by a Foreigner? | |

| Representative office | Yes | No | No | Yes |

| Branch | Yes | Yes | No | Yes** |

| Subsidiary | Yes | Yes | Yes | Yes |

| Joint Venture | Yes | Yes | Yes | No |

**Indirectly owned by Beijing WFOE.

1) Representative Office

1.1 Expenditure payment to company’s vendors and employees

1.2 Payroll compliance issues handling

1.3 No need to issue local invoices in your representative office

1.4 The sale is directed to the parent company

2) Consulting WFOE

2.1 It is a legal entity and independent domestic company

2.2 Some cities can only issue General Sales Invoice, not VAT Sales Invoice

3) Trading WFOE

3.1 It is a legal entity and independent domestic company

3.2 General and VAT Sales Invoices issuance, expense payments and inventory purchasing

4) Manufacturing WFOE

4.1 It is a legal entity and independent domestic company

4.2 Issues General and VAT Sales Invoices

4.3 Minimum Capital depends on company’s business plan

5) Branch owned by Beijing WFOE

( China can not being allowed setting up Foreign-owned Branch, but after setting up Beijing WFOE, you can use it to set up its branch everywhere in China)

5.1 Direct issuance of sales invoice to the client by your branch

5.2 Payment of expenditures and inventory purchasing

5.3 Not a legal entity; all of its behavior is on behalf of your Beijing WFOE

Beijing WFOE on-line Accountant Services

After completing WFOE Registration, we provide Trust-EnhanserR 4 in 1 services:

*Accounting and Tax Compliance

*Finance and Online Bank account creation

*Cloud Accounting System Platform

We provide Trust-EnhanserR 4 in 1 services for these enterprises (abbreviated as WFOE) in Beijing. We undertake four functions including Accounting & Tax, Finance & Online Bank account creation, Payroll Compliance, and Cloud System Provision. WFOE stands for Wholly Foreign Owned Enterprises.

We will act as your in-house accountant using web-platform system to create a collaborative working environment. Evershine staff don’t need to sit in your office but act as your accountants.

No need for you to fill your Accounting, Finance, Payroll and IT Departments in your WFOE in Beijing. Fraud-proof, Seamless collaboration, Hassle-free are some of our service features.

Your company’s CFO or any assigned personnel can approve payment request/s and do the money transfer through online banking anytime, anywhere!

As Evershine’s Standard Operating Procedure (SOP), we issue monthly reports within seven (7) days in compliance with IFRS.

We use a web-platform in servicing our clients belonging to our spin-off company, Evershine BPO Service Corp.

Our service also includes:

Payroll Cycle — Leave Application, Shifting Schedule, Payroll Calculation, Insurance, Pension Fund, Pay Slip Provision

Expenditure Cycle — Expenses: Employee, Office & Travel

Receiving Cycle — From Order to Cash

Payment Cycle — Purchases to Payment

General Ledger — Records to Report

VAT Filing

Cost Accounting

Beijing Payroll Compliance Service

Our Service Coverage

* Company Registration of Beijing WFOE (Wholly Foreign Owned Entity)

* Work Permit Application in Beijing

* Working Visa Application in Beijing

* Local Services for expatriates like airport pick-up, hotel and renting, bank account etc.

* Online Payroll Management System

* File for listing and delisting of Social Insurance and Housing Fund

* Gross salary calculation based on fixed and Non-Fixed Salary, Leave and Overtime

* Social Insurance Charge paid by the company and employee

* Housing Fund Charge paid by the company and employee

* Withholding Tax

* Gross salary and net-cash salary

* Salary wire transferring services

* Delivering payment slip to each employee

* Accepting query from each employee.

* Monthly withholding tax report to Tax Bureau.

* Severance pay application

Our Online Payroll Management System includes the following modules:

* Online Basic Data collection

* Online Payroll Parameter collection

* Online Leave authorization

* Online Overtime authorization

* Online Payroll Calculation

* Online Proposal authorization

* Online Pay slip

* Custom tailor made if necessary

* Salary wire transferring services through local web banking function authorized by three roles including “Maker”, “Reviewer” & “Approver”. Evershine staff will play “Maker” role.

Payroll Compliance Regulations in Beijing

1. Once an employee is on board, he/she needs to apply for Social Insurance on the 1st day. If an employee wishes to leave the company, he/she must file her removal from social insurance.

2. Payroll for each employee includes taxable salary and tax-free salary. Taxable salary must pay withholding income tax with rates varying according to the number of his/her dependents. Income tax withheld by company must be paid to the Tax Bureau before the 15th day of following month.

3. Each employee must have social insurance and pay housing fund. Computation is derived from “last year’s average monthly salary” as a basis in multiplying certain percentage. Chinese government authority will provide “last year’s average monthly salary” of earners every end of March. This base will be calculated from April to next March. Except when an employee bear his/her portion fees, employers have to undertake most of them. Payments shall be made to the Bureau of Labor Insurance, National Health Insurance Council and the Employee Pension Board before the 15th day of the following month.

How do we collaborate with your subsidiary staff to do payroll processing job?

First, your staff will use Online Payroll Management System, designed by Evershine, to provide accurate information

1. Using Evershine system, your employees can fill in salary-related information, such as fixed salary, non-fixed salary, Leave data, Overtime data, “Last year’s average monthly salary”, Bank account information, E-mail Address, etc.

2. If you have your own human resource management system, you can provide us your monthly gross salary file for us to upload them in our salary management system.

Second, we use the Payroll Calculation Module to generate Monthly salary spreadsheet

1. 3 days before payday, in accordance with data files provided by your staff, we use Payroll Calculation Module to generate Monthly salary spreadsheet. It includes:

* Social Insurance Charge paid by the company and employee

* Housing Fund Charge paid by the company and employee

* Withholding Tax

* Gross salary and net-cash salary

2. Monthly salary spreadsheet must be approved by your authorized personnel staff.

3. After approval, file will be uploaded to your assigned bank for direct money wiring to each employee’s bank account.

Third, we present pay slip through different delivery routes in secure ways as below:

1. Individual pay slip delivery by email in .pdf format with encryption

2. We also allow each employee to check his/her own pay slip through cloud server.

3. Questions and clarifications are handled by our personnel over the phone.

Other Services

#ChinaEmploymentOutsoucing

#Chinaworkingvisa

#ChinaPEO

#ChinaPatentFee

#ChinaDD

#ChinaTrademark

Contact Us

E-mail: ams2cn.north@evershinecpa.com

or

For Netherlands going-out cases, the coordinator window will be

Evershine Management and Consulting GmbH

Project Manager Anna Wang, who speaks Dutch, English, and Chinese.

or

Evershine Affiliates in Beijing, Shanghai, Xiamen, Shenzen etc

Manager Bing Weng, UK Master Graduate, a well-English speaker

Mobile: +86-180-5008-2372

Tel. No.: +86-592-573-4710

wechat:yaoren01522

EVershine Affiliates Information

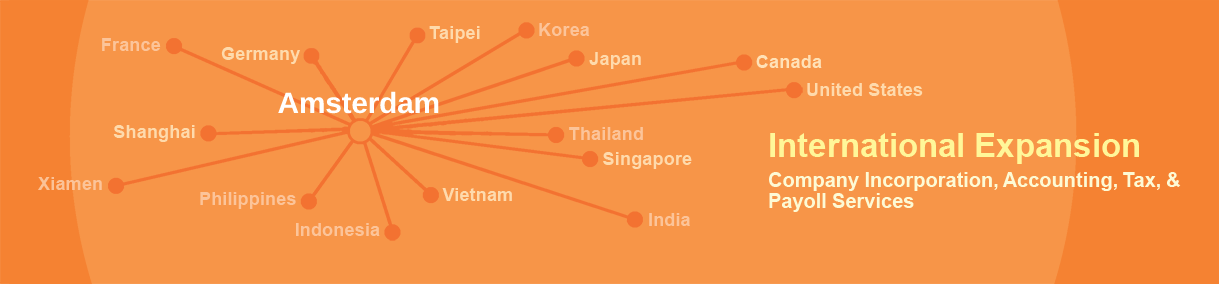

Evershine has 100% affiliates in the following cities:

Headquarter, Taipei, Xiamen, Beijing, Shanghai, Shanghai,

Shenzhen, New York, San Francisco, Houston, Phoenix Tokyo,

Seoul, Hanoi, Ho Chi Minh, Bangkok, Singapore, Kuala Lumpur,

Manila, Dubai, New Delhi, Mumbai, Dhaka, Jakarta, Frankfurt,

Paris, London, Amsterdam, Milan, Barcelona, Bucharest,

Melbourne, Sydney, Toronto, Mexico

Other cities with existent clients:

Miami, Atlanta, Oklahoma, Michigan, Seattle, Delaware;

Berlin, Stuttgart; Prague; Czech Republic; Bangalore; Surabaya;

Kaohsiung, Hong Kong, Shenzhen, Donguan, Guangzhou, Qingyuan, Yongkang, Hangzhou, Suzhou, Kunshan, Nanjing, Chongqing, Xuchang, Qingdao, Tianjin.

Evershine Potential Serviceable City (2 months preparatory period):

Evershine CPAs Firm is an IAPA member firm headquartered in London, with 300 member offices worldwide and approximately 10,000 employees.

Evershine CPAs Firm is a LEA member headquartered in Chicago, USA, it has 600 member offices worldwide and employs approximately 28,000 people.

Besides, Evershine is Taiwan local Partner of ADP Streamline ®.

(version: 2024/07)

Please contact us through HQ4ams@evershinecpa.com

More services in more cities please click Sitemap