Taiwan Cloud Accounting Payroll Tax Services ams2tw

Amsterdam and Taiwan Colleagues collaboratively to serve you. Reducing air travel, remote online financial control. your trusted partner. We act as your local in-house accountant and HR payroll staff. Evershine undertakes four functions including accounting and tax compliance services, maker role in internet banking, payroll processing and compliance services, supported by cloud accounting and payroll system.

e-mail: ams2tw@evershinecpa.com

or

For Netherlands going-out cases, the coordinator window will be

Evershine Management and Consulting GmbH

Project Manager Anna Wang , who speak in Dutch, English and Chinese.

We act as your local in-house accountant and HR payroll staff

Evershine undertakes four functions including accounting and tax compliance services, maker role in internet banking, payroll processing and compliance services, supported by cloud accounting and payroll system.

Sharing of accounting professionals

By using the Cloud Accounting System to provide a collaborative work environment, we act as your in-house accountant role although we are not sitting at your company’s office.

If your company adopts our services, you only need to assign an accountant located at the site of parent company to take care of your subsidiary accounting jobs. You don’t need to hire any local accountant, a cashier, a payroll handler, and IT officer to take care of your subsidiary in other countries.

We also incorporate internet banking function of many famous banks to enable your personnel to review or/and approve for wire payment to suppliers and employees at any time at any location.

Your company will not need to leave the seal (company seal) or/and the stamp (name of representative) to any local staff in order to avoid losing financial control.

In addition, we can make monthly IFRS financial statements within next five working days.

There are three major features of our service:

Fraud-Proof (with internal control), Seamless Collaboration, Hassle-Free (easily implemented).

You do not need to recruit your own local in-house accountant in Taiwan

Both of your staff in Parent company and Evershine Taiwan staff work together to undertake all accounting functions required by your Taiwan WFOE.

Evershine will act as the role of an in-house accountant in your Taiwan WFOE.

Evershine services will be supported by Cloud System plus Internet Banking.

Service Scope

Accounting and tax compliance

Cashier and Internet Banking as a maker

Payroll processing and compliance

Provide Cloud Information System to support our services

**Our services are called as Non-audit services in accounting industry.

There are 12 service types

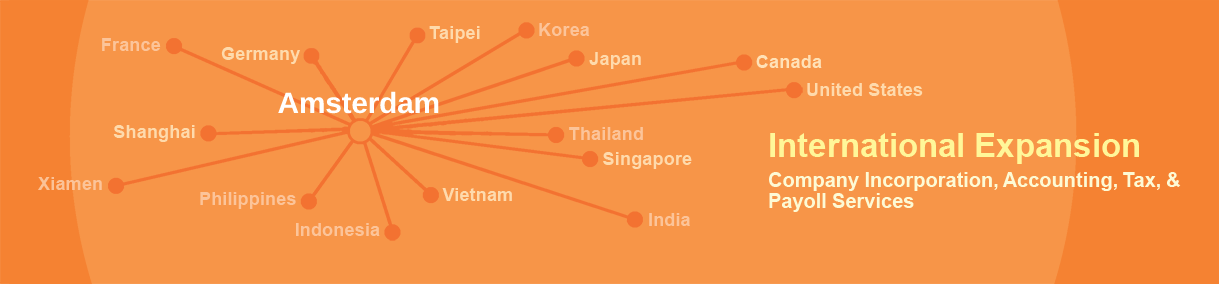

Evershine has been serving about a thousands of clients in 42 cities in 14 countries.

There are 12 service types through inductive analysis as below:

*Temporary Employment Outsourcing (EOS, employment of in-country personnel prior to the establishment of a foreign company)

*Payroll services (ELP, Payroll and Compliance, Leave and Absence and Compliance with Labor Regulations)

*Light Manufacturing Enterprises (LMF, after purchasing raw materials, by itself or outside light processing)

*Trade Type (TRD-B2B, Import and Export of goods, Wholesale)

*Project-based (PJT-B2B, small number of sales transactions, large number of purchases)

*E-commerce type (ECB-B2C, Retail of goods)

*Store sales (RTL-B2C, use POS to sell goods in the store)

*Service cost plus certain % as revenue (CPC-B2B)

*General Service (SVC-B2B)

*Store Service (ECS-B2C, using POS to provide service in the store)

*Representative office (RO, payroll plus expense reimbursement)

*Dormant type (DM, Dormant, early establishment, as long as the GLA general ledger accounting services)

The following are classified as ABC Types:

according to how the IT system and the number of modules being used.

Type A:

Taiwan Subsidiary use All System modules provided by Evershine CPAs Firm:

*BIZ-Cloud Selling-Purchasing Inventory System

*BPO-Cloud A/R and A/P system

*AIS-Cloud Accounting Information System

*Payroll-Cloud Payroll Relevant System

*VAT-Cloud VAT Filing System

Type B:

*Your Taiwan WFOE will use Evershine Modules except BIZ.

*In Evershine, we call Purchase-Sales-Inventory System as BIZ.

*Your Taiwan WFOE will use the Purchase-Sales-Inventory System supported by your parent company’s ERP.

*In this scenario, Your Taiwan WFOE will use the Evershine Cloud System module, except BIZ.

Type C:

Your Taiwan WFOE will use your parent company’s ERP system, along with some modules from Evershine

*CDEC-Payroll-Data Exchange & Processing Module

*CDEC-VAT-Data Exchange & Processing Module

*CDEC-AIS-Journal Entries Data Exchange & Processing Module

*CDEC-BPO-Payment Data Exchange & Processing Module

**A, B or C, can be easily converted

The following descriptions will assume your company using Type A services

Type A service scope:

Type A service coverage includes:

*Payroll Cycle — Leave Application, Over-shift application, Payroll Calculation, Money Movement on behalf of you to make a batch payment, Statutory Insurance, Pension Fund, Pay Slip Provision

*Expenditure Cycle — Expenses: Workflow Employee, Office & Travel, Money Movement on behalf of you to make a batch payment

*Receiving Cycle — From Order to Cash Received

*Payment Cycle — Purchases to Payment

*General Ledger — Records to Report

*VAT Filing

*Cost Accounting

*Physical inventory

*Corporate Provisional Income Tax filing and paying

We act as your in-house employees when you adopt Type A Service:

Evershine provides 4-in-1 service. If your company adopts our service, we can perform four functions, Including accounting and taxation, cashier and internet banking function as a Maker, payroll processing and cloud systems for supporting our services.

By providing a collaborative work environment with the cloud accounting system, we act as an internal employee of your company, although Evershine colleagues do not sit at your company.

Adopting our four-in-one service, you even need not hire accountants, cashiers, payroll handlers, and information personnel.

Staff of your parent company and Evershine employees jointly perform accounting functions.

We also incorporate internet banking function with many banks to enable your personnel to work at any time, to do approval for payment to suppliers and employees at any location. Therefore you will be no need to hand over the seal (company seal), stamp (name of representative) to any local person, to avoid losing financial control.

In addition, we can produce the financial statements for the last month within next five working days. There are three major features of our service: Fraud-Proof, Seamless Collaboration, Hassle-Free.

We have been serving thousands of clients:

These clients are from Taiwan, China, USA, Canada, UK, Hong Kong, Singapore, Japan, South Korea, Thailand, Dubai, Scotland, Brazil, France, Italy and Japan. About one-third of the parent companies are listed on the stock market in their home country.

Advantages for using Type A service:

*Parent company will feel more trusted for Taiwan WFOE operation; Let your management team focus on business, management and financial analysis.

*You don’t even have to hire basic accountants, cashiers and payroll staff.

*Issue IFAS financial statements within 7 days.

*The financial staff of the parent company may participate in the approval in different places and see the outstanding payments and receivables in a timely manner.

Service Characteristics of Type A Service:

*This services is supported by cloud accounting and payroll system

* Lead by multinational experienced accountants to ensure the effectiveness of internal controls and compliance with regulations.

*Using native language to communicate with the finance department of your parent company, such as English, Japanese, Japan, Philippine takalog and Indonesian.

*If adopting Type A service first, you can switch to Type B or Type C service in the future.

Contact Us

e-mail: ams2tw@evershinecpa.com

or

For Netherlands going-out cases, the coordinator window will be

Evershine Management and Consulting GmbH

Project Manager Anna Wang , who speak in Dutch, English and Chinese.

or

Call us in working hours (Taipei and China Time)

Manager Ms. Kerry Chen, USA Graduate School Alumni (English & Chinese speaker)

Tel No.: +886-2-27170515 ext. 105

Mobile: +886-939357000

Skype: oklahomekerry

Evershine Global Service Sites for Reference:

Evershine’s 100 per cent affiliates:

Taipei Evershine. Tpe, Shanghai Yonghui. Sha, Beijing Yonghui. Pek, xiamen yonghui. Xmn, Evershine, San Francisco. Sfo, Amsterdam Evershine. Del, Seoul Evershine. Sel, Hanoi Evershine. Han, Bangkok Evershine. Bkk, Singapore Evershine. Sin, New Delhi Evershine. Del, Manila Evershine. Mnl, Berlin Evershine. Ber, London Evershine. lon

Other Already-providing-service Cities:

Kaohsiung, Hong Kong, Shenzhen, Dongguan, Guangzhou, Qingyuan, Yongkang, Hangzhou, Suzhou, Kunshan, Nanjing, Chongqing, Xuchang, Qingdao, Tianjin, Sydney, Australia, Kuala Lumpur, India 4 cities, Vietnam, Jakarta, Manila, Turkey, Istanbul, Japan 4cities, Paris, Amsterdam

Potential Serviceable Cities:

For any other city you wish to visit, please refer to the following two websites,

IAPA Find out Member Firm of IAPA

and LEA Find out Member Firm of LEA

This is the membership of Evershine’s international accounting firm in each city

About 900 member offices, 38,000 people, 450 cities

We can arrange services for your company’s overseas subsidiaries as long as you are in these cities

Please contact us by email at HQ4ams@evershinecpa.com

Other Related Services Links:

>>Other Services in Taiwan

>> Accounting Services in Other Cities of China

more cities and more services sitemap